The Pickering Airport is expected to be built in several phases, with the first phase to be the most expensive. A source close to one group interested in the full development has indicated that the project could cost $3.6 billion over 25+ years, with $2.1 billion needed to fund the first phase of the project, delivering a full-function aviation facility. This is expected to include the associated water, sewer, power and road services. Opponents of the airport claim that building it will be a multi-billion-dollar waste of taxpayer money. To anyone familiar with how major airports are funded and run in Canada, this claim creates confusion for a simple reason. Since the 1990s almost all major Canadian airports have been run and funded privately.

Major Canadian airports are usually run by not for profit corporate enterprises or “Airport Authorities “ using privately raised capital. The Pickering Airport is expected to follow this model once the airport project is underway. A new PAA (Pickering Airport Authority) can be created with local community support, which may include inviting existing private companies to form a consortium. The initial construction and operation of the airport would then follow the well-proven Public Private Partnership model (P3 or triple P) used on other major infrastructure projects such as the Confederation Bridge.

In a P3 model the federal government will provide the land lease plus a one-time initial stake with the provincial and local civic entities providing the road/water/sewer/power infrastructure. Based on P3 principles, the Public i.e. the various levels of government, would provided 25 percent of the total project funding, an amount of about $900 million. The new PAA would fund the rest of the airport development (the 75 percent of the costs) and operations with private capital. This follows a pattern established with lessons learned from the very first P3, the highway 407 project.

Once built, the PAA is expected to follow the successful example of, and to provide a competitive nudge to, the GTAA (Greater Toronto Airports Authority). Despite its grandiose sounding name, the GTAA runs only one airport, Toronto Pearson. The GTAA is a not for profit corporation that currently has a 60-year lease on the federally owned land on which Pearson airport sits. In 2017, the GTAA paid the Canadian tax payer $156.9 million in rent and currently has $6.5 billion dollars of debt (bonds) used for capital build-outs and airport operations. Another example is the Vancouver Airport Authority which manages Vancouver International airport. In 2007 it also purchased much of the private consortium that has a 40-year lease (since 1996) of the land comprising the Hamilton Airport. For competition reasons neither of these groups is expected to be allowed by the federal government to be part of the new Pickering Airport Authority.

The airport authority and P3 models can work well as long as these powerful companies are properly governed. Runaway executive payouts, empire-building, and out right corruption are well known pitfalls of large not-for-profit corporations, and even large charities are not immune. In addition to overcoming the capacity limitations of Pearson airport, capping jet noise over Toronto, the PAA will also provide a competitive balance to the GTAA and keep its empire building in check. Our federal politicians must ensure that the enormous economic power our airports wield does not overshadow the public interests they exist to serve. Today, not only are these airports not a burden on the Canadian taxpayers, the corporations running them pay a significant yearly rent back to the federal government.

If the new Pickering Airport Authority follows the path of other major Canadian airports, raises capital with private market bond offerings, and pays rent to our government, where is the risk to the Canadian tax payer? The real risk is that taken by the private bond holders not the tax payer and with the increase in Canadian air travel and Pickering airports large passenger catchment area, this risk is extremely low.

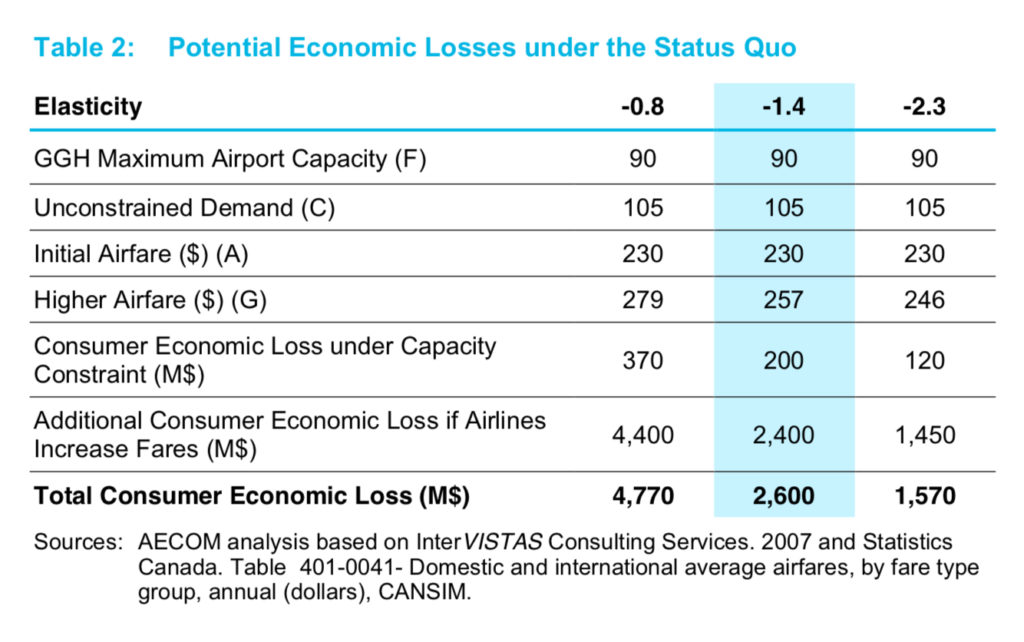

There is a very high cost to the tax payer and the traveling consumers if the Pickering Airport is not built. A study commissioned by the Durham region, estimates that if the airport is not built, by 2040 the total yearly consumer welfare loss will be between $1.6 to $4.8 billion. This is not even accounting for the lost tax revenue, the land lease revenue the PAA will generate, and the risk congestion at Pearson will create for Toronto’s reputation of being open for business.

If Pickering airport is not built, by 2040 the total yearly consumer welfare loss will be between $1.6 to $4.8 billion.

The bottom line is that the billion dollar a year risk to the Canadian Tax payer occurs only if the airport is not built! With billions at stake, we have not a moment to lose. Our federal politicians need to stop being sidetracked by the business interests that will profit from congestion at Pearson and give the green light to build the new Pickering Airport.

This is not much help