The GTAA ( Greater Toronto Airports Authority) runs only one airport, Canada’s busiest, Toronto Pearson International airport. Pearson is the only jet airport inside Torontos passenger catchment area, and according to Standard & Poors credit rating service, it is a monopoly providing essential travel services to 17% of Canadas population. One in six Canadians must rely on the GTAA’s services.

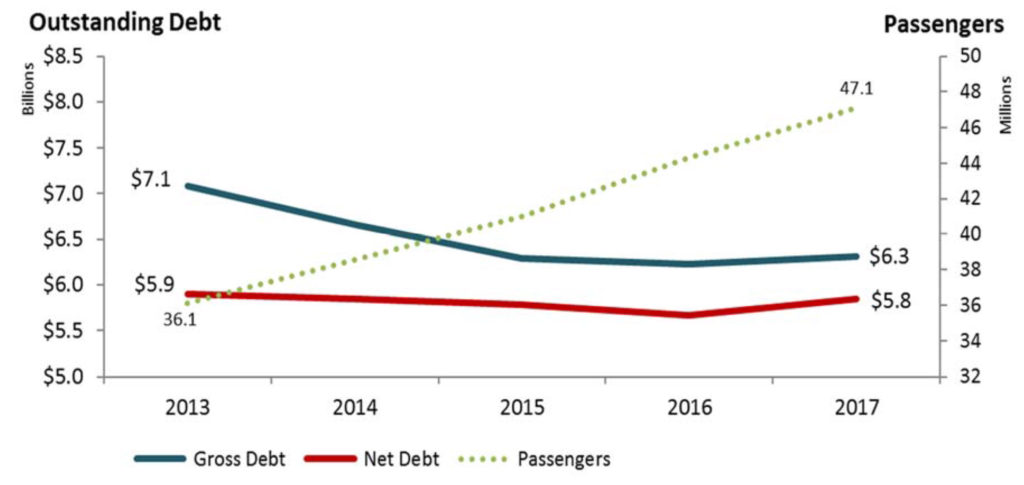

In 2012, Standard & Poor’s affirmed an “A” rating for long-term credit and senior secured debt at the Greater Toronto Airports Authority. It cited the GTAA’s monopoly position as operator of Pearson airport and a stable outlook. Although S&P noted the authority’s high debt($ 6.3 billion Cdn) and cost burden compared to other airports in the rating system, it said that the unusual monopoly at the heart of GTAA makes it a good bet.

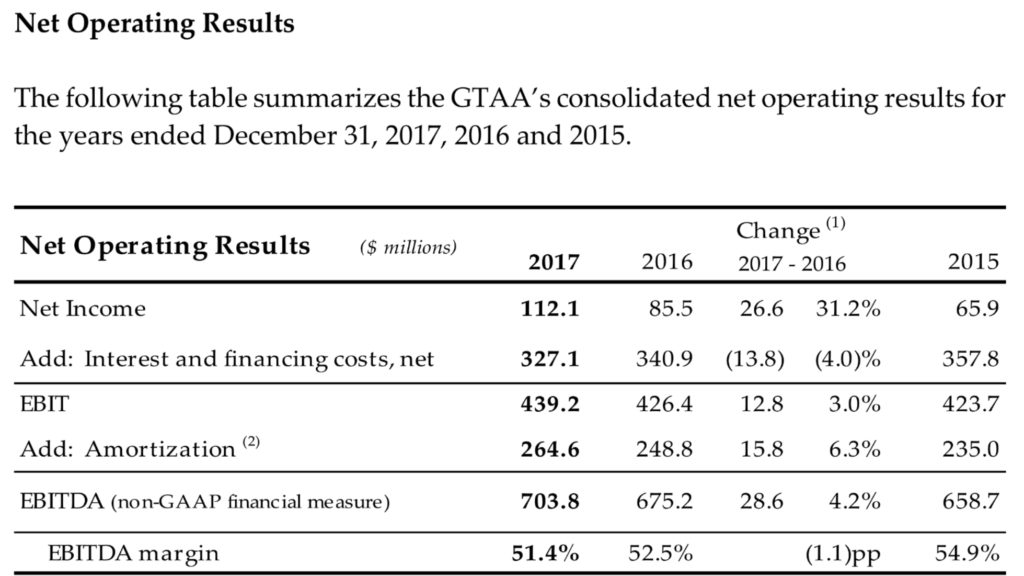

The fear by the investors that hold the GTAA’s debt is that the moment Pickering airport opens and its monopoly is gone, that the GTAA’s balance sheet and credit rating will suffer. The GTAA executive team may share this fear, that a currently healthy EBITDA of $703 million and net income of of $112 million in 2017 could be wiped out by competition and the additional financial costs a downgraded credit rating would bring.

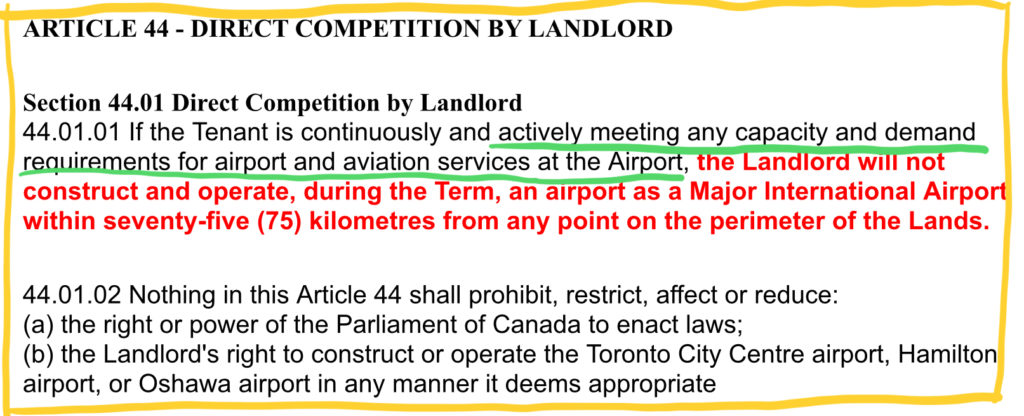

Over the last decade, that fear may have driven the GTAA to oppose Pickering airport and defend its monopoly. It can do so by utilizing a simple clause (called section 44) at the heart of its Pearson airport land lease agreement with the Canadian federal government. S&P calls out this unusual arrangement as one of the pillars of its credit report.

“Lack of competition during the term of the ground lease. The ( land lease) agreement provides protection that Transport Canada will not construct and operate a major international airport within 75 kilometers of Pearson”

Unfortunately for the GTAA, there is an out clause that states that if Pearson reaches capacity, a new airport can be built. As it happens, with its current 2% growth rate, Pearson is expected to reach its maximum capacity of 520,000 aircraft movements, as stated in its 2008 masterplan, as soon as 2023.

In what appears to be its latest shot at delaying the triggering of this clause, the GTAA’s new draft masterplan is adding a 100,000 plus movements a year. It is not building ( and does not have room to build) any significant new airside capacity at Pearson. So how is it justifying this miraculous increase in capacity that just happens to extend the live span of its monopoly? It appears to be counting on the willingness of air traffic controllers and pilots to shave aircraft wake separation margins ( safety margins). This is a strange expectation to have in an aviation industry hardwired to put safety before $$ signs. Especially at an airport with some of North America’s worst winter weather and a night curfew, with local activists calling for reducing the number of flights due to noise levels.

Transport Canada is ready. It has set aside thousands of acres of land inside the Toronto region passenger catchment area for just this moment. This billion dollar land reserve will be the home of the new Pickering airport and is expected to be built and financed independent of the GTAA monopoly by a separate public private partnership. Construction of Pickering airport could begin in the spring 2020, with an initial opening for passengers as early as 2025, and a full build out by 2030. Once fully operational, Pickering could handle 10-15 million passengers a year and generate 15,000 full time high paying jobs.

It is expected that Pickering airport will have a cost for aircraft operators of about 50% of that of Pearson airport. Like similar jet reliever airports, Pickerings main marketplace will be low-cost flights where Toronto is either the destination or starting point for the traveler. This will bring true low cost carriers to the Toronto marketplace. Pickering airports traffic is also expected to consist of at least 25% general aviation traffic, specifically business jet traffic, the growth of which has flatlined at Pearson due to high costs and limited slot access (congestion).

While this will initially cut into the GTAA’s bottom line by undercutting its monopoly (a key pillar in its S&P credit rating) and encumber its pricing power, there are long term benefits as well. The expected shake up in Toronto’s aviation infrastructure will be good for consumers and Canada’s economy as a whole, but can also clear a new path that will benefit the GTAA in the long run.

A new regional reliever airport in Pickering can benefit Pearson operations by reducing the number of small business jets utilizing Pearsons expensive infrastructure. This will both free up arrival and departure slots at Pearson for larger ( more profitable) aircraft as well as improve the wake turbulence safety margins for these jets. Instead of trying to handle everyone, Pearson can now focus on traffic befitting it’s high end infrastructure.

The GTAA’s denial of Pearson’s capacity limits and the rumored but rarely seen decade long passive-aggressive fight against building Pickering airport is the wrong approach to its own prosperity. Both safety margins and the GTAA’s bottom line could be improved if it instead focuses on larger passenger aircraft from established carriers requiring connections to other flights and carriers. Everything else can be allowed to flow naturally to a lower cost Pickering airport. This would also help the GTAA reduce and even reverse the growth in jet noise complaints over the last five years. Pickering airport is the Toronto region’s solution to its jet noise problem.

The fate of the GTAA’s monopoly now rests in the hands of the federal Minister of Transport. Assuming the honorable minister is able to withstand the influence of a entity that accounts for 6% of Ontario’s GDP, we can expect a timeline for Pickering airport’s development late this year.

The GTAA’s current ( as of 2018) A+ credit rating is middle of the road investment grade. With effective competition from Pickering, the fear is that this could slip several notches resulting in millions in added operating cost. Currently, according to its SEDARs filing , it is costing at least $327 million a year to finance its $6.3 billion dollar debt load. But is the GTAAs credit score really at risk or is this fear mongering?

The GTAA’s total debt per passenger, one of the airport industry’s key financial metrics, has declined steadily since 2013 and has a downward trajectory looking forward. The GTAA will have up to 10 years before Pickering is fully operational and it appears that it is already cleaning up its balance sheet.

According to the GTAA’s 2017 SEDAR filing, it is on solid ground with a net income of $112 million in 2017. It has also been purchasing hundreds of millions of dollars in real estate investments including a nearby convention center.

Change is hard, but it is also one of life’s only constants. The GTAA executive team now has an opportunity to look past Pearson’s capacity limits and embrace a competitive future. Pickering airports time has arrived, and the only thing the GTAA and its debt holders should fear is fear itself.