If you live in Pickering Ontario, you may have heard comments during the last municipal election that development of the Federal Pickering Airport lands will increases taxes, specifically residential property taxes.

We have looked at this and have bombshell good news. Taxes across Durham region will be going down thanks to the new airport.

Once the 9000-acre (3600 hectares) site set aside for a new airport and associated AEZ (Advanced Enterprise Zone) is developed, it will generate municipal tax revenue that is expected to at least double the current City of Pickering’s operating budget. The revenue from this new economic engine could enable the slashing of existing residential property tax rates in Pickering to the lowest level among the municipalities of the Greater Toronto Area. Just as important, all of Durham region should see tax reductions thanks to the City of Pickering remitting more than half its revenue to the region.

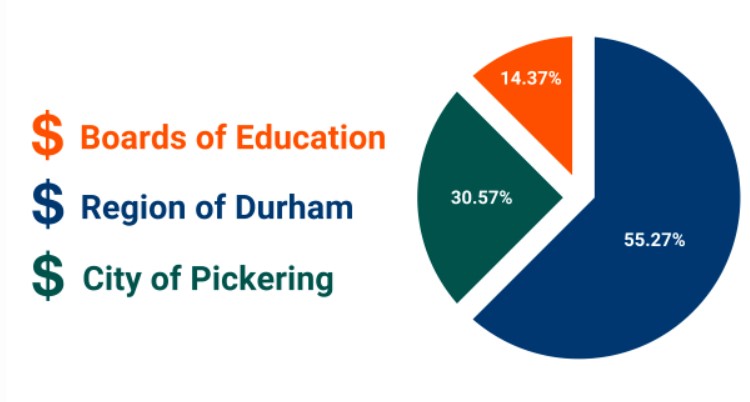

In 2022, 31 % of the tax revenue levied by the City of Pickering was spent on its operating budget of $74 million. The remaining went to fund education (14 %) and 55% went to the Region of Durham as shown in Figure 1.

Durham Region is made up of eight local area municipalities including Ajax, Brock, Clarington, Oshawa, Scugog, Uxbridge, Whitby and Pickering. Through the taxes submitted by Pickering to the region, all will benefit from tax revenue created by the new airport.

Our estimate puts the expected municipal tax revenue from the Pickering Airport lands at a staggering $247 million a year once fully occupied over the next two decades. This is triple the current City of Pickering operating budget. The increased revenue will come from two new sources.

First will be the new airport itself where Pickering can expect a fee per passenger as Payment In Lieu of Property Taxes (PILT). Both Toronto Pearson and Toronto Billy Bishop airports pay PILT to their respective municipalities. Pickering airport should pay the same fees per passengers as these airports. Pickering airport PILT should generate at least $14 million per year [2].

But the heart of Pickering’s new economic engine will be the more than 30 million sq ft of industrial and commercial space and at least 950 hectares of associated serviced land in an Advanced Enterprise Zone (AEZ) build around the new airport. The AEZ will be an incredible source of property tax revenue not just for the City of Pickering but for all of Durham Region.

While there is uncertainty associated with the precise breakdown and use of the future employment land, including assessment values, vacancy rates and type of use, an estimate can be made. For this calculation footnotes on data sources are noted in brackets [1].

It is assumed that future values of the Pickering Airport lands will reach the same minimum and median values found elsewhere in the GTA, especially Markham and Richmond Hill. Using an average of $3.7 million[3] per hectare ($1.5 million per acre), the 950 hectares, minus the 30% area with buildings[4], will have a value of $2.46 billion. At a build cost of $210.00 a square foot [5], the 30 million square feet of new buildings is worth $6.3 billion. Today the City of Pickering has a range of tax values base on the use of the building and land. To keep it simple this analysis will use an 80: 20 Industrial to Manufacturing/Office/Commercial split for development of the AEZ for a weighted Pickering tax rate as 2.69%.

At this tax rate, the buildings in the AEZ will generate $167 million dollars and the land another $66 million in new property tax revenue.

Combined, commercial sq ft and industrial land tax levies will total at least $233 million a year plus the $14 million PILT for a total of $247 million [6]. Of this total, $76 million will be retained by the City of Pickering.

Even more interesting is that property taxes will be only part of the new revenues generated by the development of the Pickering lands for governments at all levels. For instance, it is expected that there will be at least $400 million in development charges, a quarter of which will go to the city of Pickering.

The overall development of the Pickering Airport lands will generate billions in economic activity and at least $500 million in income tax every year for federal and province governments.

New tax revenue for all levels of government is always welcome news but property taxes are the financial backbone of the City of Pickering and the Region of Durham. Collected by the city and split with the region, property taxes account for the majority of revenue considering all sources available to the City. These taxes are used to finance education, police and fire departments, parks, and other services. Property tax rates, along with access to local jobs and services, will shape the local housing market by influencing the costs of buying or renting homes and apartments.

The new tax revenue will ramp up over the next two decades after the airport opens (estimated in late 2028).

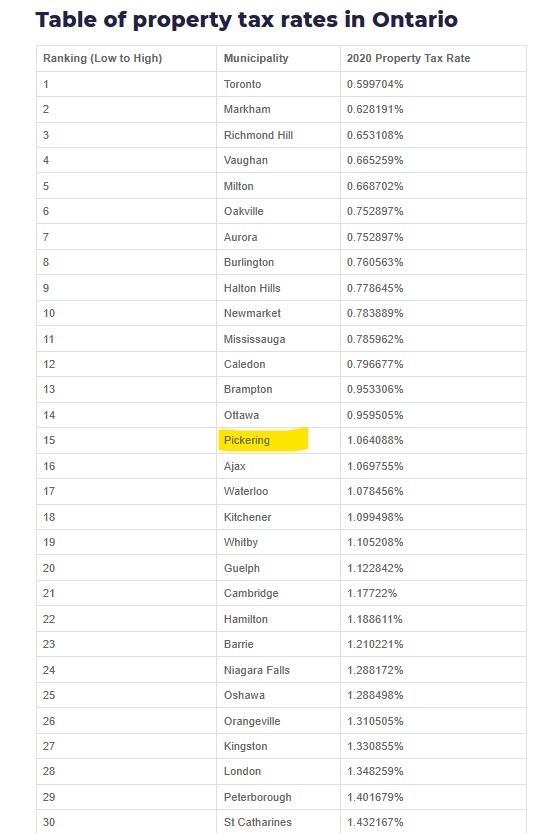

The new revenue will be a welcome relief for Pickering homeowners who have seen taxes increase year over year for the last twenty years. The current residential tax rate in Pickering for 2022 is 1.1% of the assessed value of a home. A typical residential property assessment in Pickering, according to the Municipal Property Assessment Corporation, is $530,000. That equals to an average property tax of $5,830 a year. In comparison, the tax rate in Mississauga is 30 percent lower at 0.78%. Property taxes on a similarly values home would be only $4,134, a saving of $1,696 per year.

Toronto, Markham, Richmond Hill and many other cities in the Greater Toronto Area, with balanced industrial and employment areas, also have lower tax rates. Cities further away from areas of high commercial value have property taxes higher than Pickering. For Instance, Oshawa’s tax rate is 1.29%. Geography, transportation logistics, political considerations and home values can skew this relationship. In addition, the lower the value of the properties in a city, often the higher the tax rate needs to be to cover basic services. (Note that lower rates exist in some hamlets and smaller towns with high value homes or reduced services).

Cities outside of Durham region, but close to the airport, such as Whitchurch-Stouffville or Markham, will also have the opportunity to host new commercial investment and the related rise in municipal revenue. Commercial and Industrial properties are usually taxed at a higher rate than residential, do not need educational services so are usual encouraged. In Mississauga, the commercial tax rate is 50% higher than the residential tax rate. In Pickering, it is double the residential rate.

What effect could the new airport ultimately have on residential property taxes?

With more commercial properties, the effect of the new commercial zone surrounding the airport should lower residential property taxes. This is due to the greater share of the tax base being paid by commercial properties as well as an expected increase in residential property values close to new jobs. If the tax rates and split with the region remain unchanged, the airport would double the revenue the city has to spend on each citizen. Alternatively, it could freeze or cut residential property taxes dramatically.

Ultimately it will be up to elected municipal officials on the best use of this revenue.

Will it be used to cut taxes in half or make Pickering and Durham region the best place in Canada to call home? Will it be used to help those in our society that are less fortunate? The choice is up to you the voter. Supporting the development of a new airport in Pickering is the key to a prosperous future and new opportunities.

References:

Property Taxes – City of Pickering

Ontario Cities with the Highest & Lowest Property Tax Rates – October 2022 – nesto.ca

Canada’s property tax rate balance tilts against commercial properties | Financial Post

2022 Approved Current Budget Summaries (pickering.ca)

Pickering own tax up 1.79% in approved 2022 budget – Durham Post

AltusGroup 2022 Canadian Cost Guide for industrial, manufacturing and office costs in the GTA

Realtor.ca , for vacant, serviced industrial lands for sale in the Greater Toronto Area.

Calculation footnotes

- The 950-hectare area of the Advanced Enterprise Zone is the total area of the Federal lands less the airport precinct including its airside employment lands, the natural heritage system, roads and stormwater management facilities external to the airport precinct proposed by a private investor.

- PILT Rate used equal to rate at Toronto Pearson and Toronto Centre Billy Bishop airports equal to 94 cents per passenger. We are assuming that the PILT is split with the region although it should be noted that Mississauga currently retains 98% of its PILT revenue.

- Land values per acres based on “Asking Price” December 29, 2019 review as found on Realtor.ca for serviced employment lands in the GTA.

- Gross floor area assumes 0.3 FSI on AEZ lands external to airport precinct. Floor Space Index (FSI) denotes the ratio of built floor space to the total area of the property.

- Building cost per sf determined using the Altus Cost Guide 2020 and 2022 averages.

- Assessed values are estimated; MPAC (Municipal Property Assessment Corporation) will be final determinant of assessment for tax purposes.