By Ted Nickerson, March 16th 2022

Original Posting: “Passenger Aviation in the Toronto Region Will Recover Sooner Than Expected”

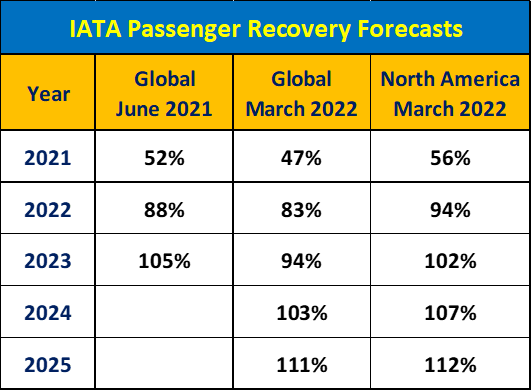

In the June 2021 posting, I showed that commercial passenger aviation in Canada is resilient in the long term and would recover fairly quickly. Quoting a media release by IATA, global commercial passenger traffic was forecasted to recover to 52% of the 2019 volume by year-end 2021, to 88% by year-end 2022, and finally to 105% by year-end 2023. I closed my previous posting by saying the predictions were very fluid at that time, and I would be following the situation and provide updates when new information became available. Now IATA has increased its growth forecast for North America although reduced it slightly worldwide.

On March 2, 2022, IATA released an updated recovery forecast covering overall global as well as regional predictions relative to the 2019 passenger traffic. The Global and North America region predictions are shown in the following table.

North America’s recovery is happening faster than first predicted, although IATA’s media release notes that the global commercial passenger recovery is not occurring as fast as it forecasted in May 2021. It will take at least a year longer (2024 vs. 2023) for global passenger volumes to recover to the 2019 level. Revenue passenger kilometers (RPKs) will also take a year longer globally.

Interestingly, the Asia-Pacific region, once the industry’s poster child for growth, is lagging other regions. The impact of COVID restrictions on international travel plays a major role in this delay.

Leading the recovery though is the North America region. North America exceed IATA’s 2021 prediction and is now forecast to reach and surpass the 2019 passenger volume in 2023.

Web searches confirm IATA’s North America region’s 2021 performance. The FAA says that USA air carriers reached 73% of their 2019 passenger volumes. Separately, Mexico aviation reached 76% of its 2019 level. And USA-Mexico transborder traffic recovered to 94%. So, if the USA and Mexico performance was over 70% in 2021, why does IATA report the overall region’s performance as 56%? The problem is in Canada!

In 2021, Vancouver International Airport processed just 26.9% of its 2019 passenger throughput. Calgary was at 35.2%, and Montreal Trudeau was at 25.7%. Vancouver’s and Montreal’s performances were actually lower than they were in 2020. Numbers are not available for Toronto Pearson International Airport but, at a Toronto Region Board of Trade (TRBOT) transportation webinar, the GTAA representative said that Pearson ended 2021 at 30% of its 2019 passenger volume.

At the TRBOT session, the representatives for the GTAA, Air Canada and Westjet pointedly placed the fault for Canada’s poor commercial passenger numbers squarely on the federal government and their highly restrictive COVID protocols for aviation. While other nations reduced their aviation travel restrictions as successes were made in their respective COVID fights, Canada did not. At the time of the TRBOT session (February 3, 2022), Canada retained some of the most restrictive passenger protocols in the world effectively choking off any possibility of recovery.

Since then, the federal government has somewhat relaxed its commercial passenger COVID restrictions but still remain tighter than those of other nations for fully vaccinated travellers. This is despite provincial governments dropping vaccine and mask mandates. Ontario is expected to be one of the last provinces to drop mask mandates on March 21st and to lift all remaining pandemic rules by the end of April. If Canada is to catch up with the USA and Mexico and fully recover to its 2019 levels and continue to grow, the federal government must get in line with other nations on COVID protocols for air travel.

Another factor is that the FAA only provides USA air carrier information. The performance of foreign air carriers like Air Canada, British Airways etc. flying to and from the USA are not included in their analysis. Without question, international and USA Canada transborder movements in 2021 by foreign carriers into and from the USA has been severely impacted by COVID. Good news is these restrictions are being slowly reduced. Recently introduced changes enable the use of cheaper, faster, and more widely available antigen testing.

On a positive note, the key GTA airports are taking action.

At Toronto Pearson, the GTAA, with a new CEO-President, are updating their 5-Year Strategic Plan. It will be interesting to see if they stay the course of their 2017 Airport Master Plan to achieve 85 million annual passengers or will the impacts of the pandemic result in a different capacity vision. It would not be surprising if the GTAA were to take a more pragmatic, bearish stance when it comes to expansions, at least in the short term.

At Waterloo airport, flights by Westjet and ultra low-cost carrier Flair Airlines will soon be joined by a new carrier, Canada Jetlines. Together, these carriers are forecasting 1 million passengers annually by 2023. This is being supported by expanding the existing terminal and a planned runway extension.

At Billy Bishop Toronto Centre (BBTC) airport, the owner/operator is confident it can double its volume to 4.8 million annual passengers by 2025/2026.

Connect Airlines is planning to start operations at BBTC in the spring. They have a plan for Q400 Next Generation hydrogen fueled aircraft as early as 2025. Increased access to BBTC (more slots, connectivity to more core markets) is key to achieving this growth.

Prior to COVID, Hamilton completed extensive infrastructure additions, and had reached 1 million annual passengers. Let’s hope it too recovers quickly. Its airport master plan is now 12 years old. An update may be in the offing.

So, how does this all play out (IATA recovery predictions, future growth forecast) in terms of passenger demand and airport system capacity in the GTAH?

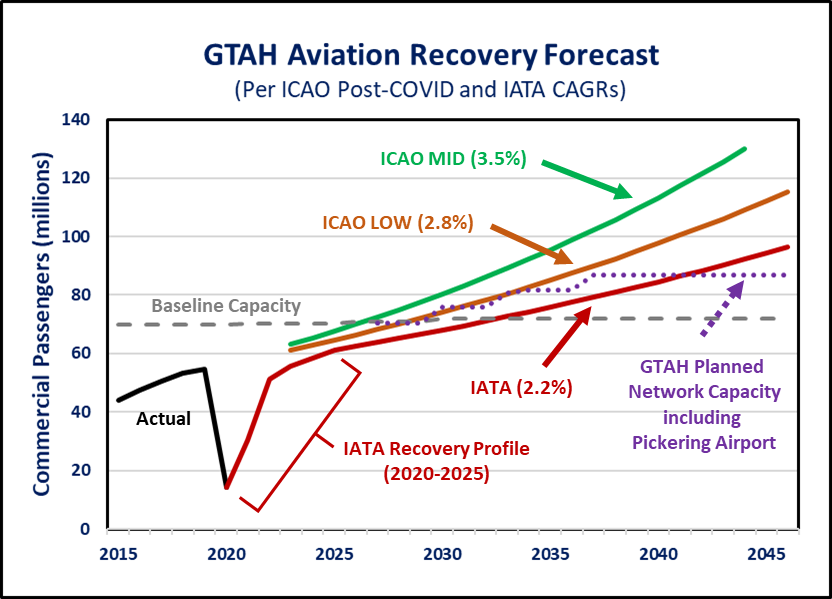

The “GTAH Aviation Recovery Forecast” chart was prepared using IATA North America’s recovery rates and timing, and post-COVID growth forecasts from IATA and ICAO. It shows that commercial passenger volumes and subsequent growth will return to the historical growth curve. The question remains how fast it will recover.

IATA’s recovery profile for North America is highly probable. With the lifting of COVID restriction, the GTAH airports should catch up to the USA and Mexico pace. IATA’s 2.2 percent CAGR is the GTAH’s worst case recovery scenario.

ICAO is more optimistic than IATA by a couple of years.

Aviation in Canada is Resilient. The GTAH commercial passenger volumes will recover to the 2019 pre-COVID level in 2023. Passenger Capacity at Pickering Airport will still be required in the same general late-2020s to early to mid-2030s timeframe.

As mentioned in my previous posting, the aviation passenger performance is fluid but hopefully becoming less so. I will continue to monitor the release of the 2021 PAX throughput of Canada’s and the GTAH’s airports, coupled with demonstrated recovery results, to see if IATA’s and ICAO’s forecasts play out in the GTAH.

References:

IATA media release #10 “Air Passenger Numbers to Recover in 2024”, 1 March 2022

ICAO website: “Post-COVID-19 forecast scenarios table.pdf”

the eco radicals never want anything more built in Canada – no highways, no airports, no bridges, no other infrastructure, while themselves continuing to use all the existing roads, airports, etc every day. If we didn’t have previous sturdy generations, Southern Ont would now look like Nunavut. They don’t want anything built (seemingly except residential condo towers). This is a catastrophe as more or less the same politically-minded groups keep accelerating the indiscriminate flow of immigrants into this country, now at half a million per year, with no plans how to service all the new population. There is 2.8 BILLION acres of land in Canada, a lot of which is arable, but farmland must be right smack in the middle of the GTA or we will all go hungry!

they don’t even want to add farmland. ALL the farmland in Ontario was forested land at some point and was cleared long generations ago. They pretend as if the land was always farmland and pretend not an inch of new farmland could be claimed from forested land, of which we have far plenty of. It’s a very bizarre proposition that we keep adding numerous newcomers to Ontario, yet are besieged by these activists to live with only all the infrastructure and resources that were made for us by previous generations. These people are ideologues and many of them have financial interests (like leasing farm land at rates next to nothing). They are completely out of touch and are leading us to economic and societal catastrophe – some of which like super expensive fuel we are witnessing now (and no, price of gas was going up much longer before Putin became an issue).