By Mark Brooks

Western Canada’s oil industry is at the cutting edge of new net-zero energy emissions technology that will be the cornerstone of our 21st century economy. Yet, woke environmental academics and far left anti-capitalist opportunist are calling for the industry to be restricted, and then shut down. The next federal budget could mark a pivotal moment in Canada’s economic future. Will the Federal government support the industry’s full-speed-ahead move towards CCUS (Carbon Capture Utilization and Sequestration) and new net-zero carbon product opportunities? Or will it listen to a handful of enviro-woke virtual-signalling academics and political elites, and forgo the mother of all emissions reduction opportunities?

Part 1: The Mother Of All Net-Zero Carbon Opportunities

The carbon capture, utilization, and storage (CCUS) investment tax credit is expected to be part of the next federal budget slated for Feb 27th, 2022. The tax credit will finally put Canadian companies on an even footing with their American counterparts, who have had their own version of this tax credit since 2008.

The move to CCUS reflects new technology and market opportunities that are moving the goalposts for Canada’s oil and gas industry. In the 20th century, the goal was one of endless growth to support a thriving economy. Today, the industry’s goals are maturing from endless growth to one of thriving in balance. A good example is the new marketplace for SAF (Sustainable Aviation Fuel) created by progressive actions by aviation regulators. Yet, some actors explicitly want to stop the oil industry from transitioning to net-zero carbon fuels such as eFuel, a fuel that can be created with captured carbon and zero-emission electricity.

Opponents to the proposed CCUS tax credit, including academics and well-known Green Party supporters, have recently signed an open letter opposing the CCUS tax credit. They claim it would “prolong the life of the fossil fuel industry” and delay the move to cleaner alternatives.

The former leader of the Green Party, Elizabeth May, correctly observed that Canada is addicted to fossil fuel. But then, she strangely argued for spending billions to shut down the oil industry, but, paradoxically, not spending one dime to transform it to produce net-zero emissions fuels. This is likely due to her lack of technological literacy, and bare-faced political expediency while pandering to the “enviro-woke”.

To date, no one has proposed a realistic plan to reduce using oil and gas consumption within a reasonable timeframe, without destroying Canada’s economy and leaving millions of this country’s citizens stranded and freezing in the dark during the next hard winter. Nor has anyone in the green movement even offered a technical argument against CCUS and the path it offers to transform the oil industry into a producer of net-zero carbon products.

Trying to imagine the carnage created by shutting down the oil industry is almost mind-boggling. Oil is used in almost everything created and consumed in our economy. From tires, plastics and steel to the fuel that drives our supply chain. Going “cold turkey” from oil would lead to trillions of dollars in lost income, stranded investments and millions of unemployed workers.

carnage created by shutting down the oil industry is almost mind-boggling. Oil is used in almost everything created and consumed in our economy. From tires, plastics and steel to the fuel that drives our supply chain. Going “cold turkey” from oil would lead to trillions of dollars in lost income, stranded investments and millions of unemployed workers.

The methods needed to force industry and consumer behavioural change of this scope will be wide-ranging and unprecedented. The government overreach needed to close down such an important free enterprise-driven industry of this size could destroy Canada’s democracy and tear the country apart.

The deficit of vision, accurate facts and technical expertise by the academics who are opposing CCUS is hard to understand. Even if their hearts are in the right place, what value is a letter signed by a Professor of Social Justice and Community Studies, or Law, or computer science if it is devoid of a real grasp of the oil industry’s technology? How many of the academics that signed this letter know or even care to know what eFuel is? Do they know that CCUS and DCCUS (Direct Carbon Capture from the atmosphere) will reduce and eventually eliminate the need to extract oil from the ground? That it could reduce all of Canada’s emissions by at least 10%, and possibly as high as 35%? With the industry on a path to net-zero carbon emissions, who in their right mind would want it to shut down?

Part 2: A Necessary Net-Zero Vision of Canada’s Oil Industry

The oil and gas industry is at the heart of Western Canada’s free enterprise-driven economy. In Alberta it creates 26 per cent of the province’s GDP and employs 600,000 people creating prosperity across Canada. In Alberta, the oil sands projects are viewed as a technological crown jewel of Canadian industry and a great source of pride for many. Canada’s synthetic oil technology and proven CCUS expertise is exported around the world.

On the political left, the oil sands are seen in a much different light. They are often denigrated as the “Tar Sands” and are the targets of demonstrations by far-left environmental groups including Greenpeace. These groups are politically motivated, well-funded and have a distinct anti-capitalist agenda. They organize protests to block the construction of new pipelines, choked off vital rail links in 2020 that hurt everyone and caused billions in economic damage. They promote the idea that the oil industry has no future in a net-zero emissions world.

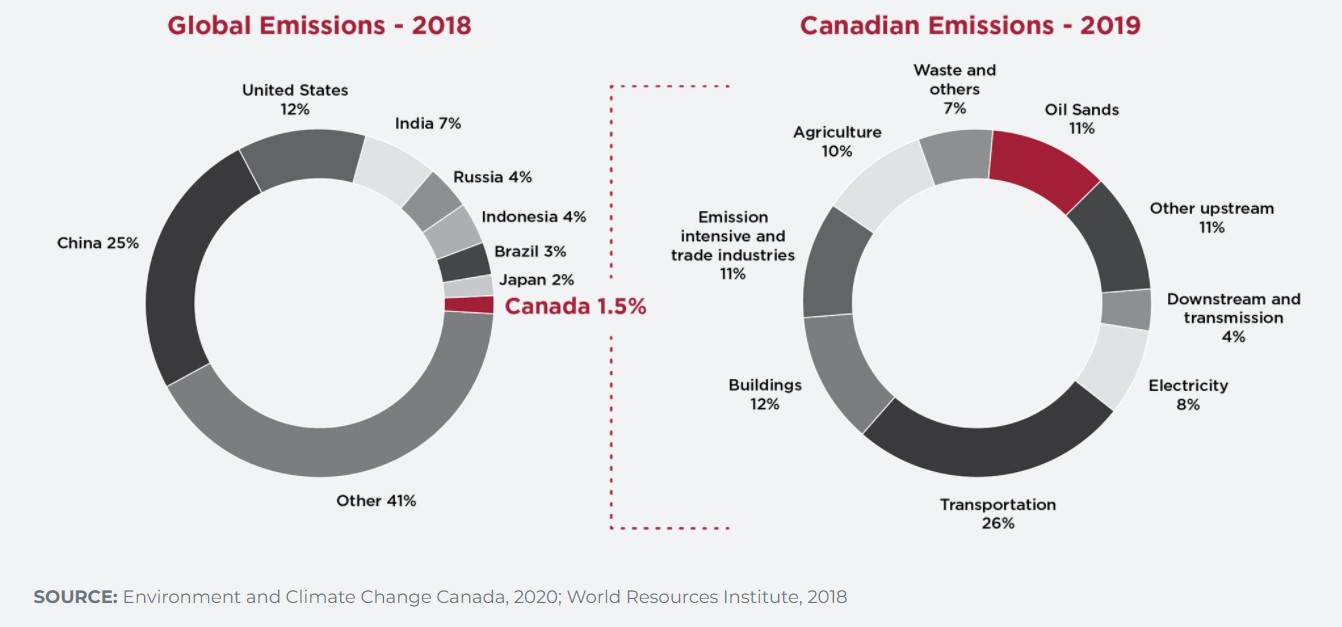

The majority of Canadians (including most Albertans, according to a 2019 poll from Abacus Data) are worried about climate change and see it as a justifiably serious problem. The oil and gas industry in Canada is a major source of greenhouse gases. The oil sands alone created 83 million tons of emissions in 2019, up 20% from 2014 as oil production increased to more than 3 million barrels a day. That represents 11% of the country’s total emissions of 730 million tons.

The Alberta and Saskatchewan provincial governments have been working diligently with industry to reduce emissions. Unlike 75% of the world’s oil industry, Canada’s oil companies are privately owned and operated. Regulating and motivating this private industry towards a net-zero emissions goal will be no easy feat, and the CCUS tax credit is expected to play an important role. It will be one more tool to help the Western provinces who have been working on incentivizing emissions reduction for decades. This includes Canada’s first industrial carbon tax introduced by Alberta in 2007. Although eclipsed by the federal government’s more consumer-focused carbon tax, the Alberta tax was set at $40 per ton until it was discontinued in 2019.

In their letter, the academics made a false claim that CCUS is not a proven technology. Perhaps they should take Air Canada (soon to be fuelled at least in part by SAF) to Western Canada to one of the CCUS sites and have a look for themselves before making such a grandiose statement. The West has been using this technology successfully for decades and currently captures more than 4 million tons of emissions a year.

The first CCUS site opened in Saskatchewan in 2000 and now captures 3 million tons a year. The latest, Shell’s Quest project, opened in 2015 and today captures 1 million tons of carbon a year at a cost of $30 million ($30 dollars per ton). Building out CCUS infrastructure to remove all emissions created by fuel extraction and refinement is an important first step. For the Shell company, this is cheaper than paying the current $50 per ton federal carbon tax. But if Shell can sequester carbon at $30 per ton, is the plan to increase the federal carbon tax $15 a year to $170 per ton by 2030 necessary?

We can not tax our way to net zero emissions, but we can incentivize our way to that goal.

Canadian oil and gas companies have said that it will cost $75-billion (about $90 per ton) to implement CCUS for all of the Canadian Oil Sands. That’s $75 billion worth of tax credits and/or direct funding to remove 11% of Canada’s total emissions. The real question should be who should pay, and how fast can we get it done, not IF it should be done.

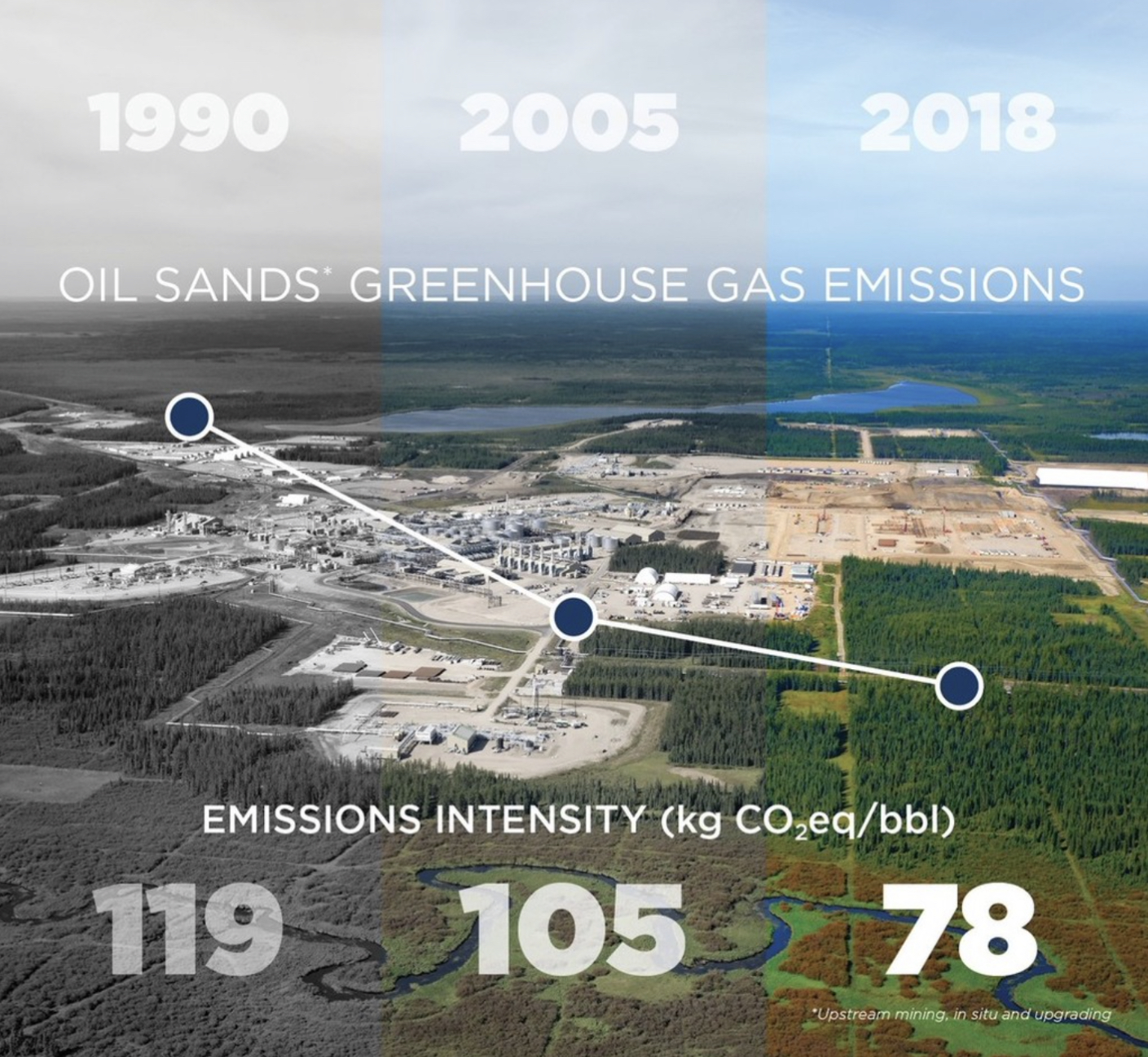

Change is happening. The Oil Sands GHG emissions per barrel produced have dropped 34% in the last 30 years. The next 30 years will see it go to zero.

An analysis performed by IHS Markit demonstrated that GHG intensity has already fallen by a yearly average of 1.5 kilograms of carbon dioxide equivalent per barrel since 2009. In absolute terms, emissions from the oil sands are expected to peak around 2027 and fall from then on, even as production increases. Today, fuel from the oil sands has the same or better “well-to-wheel” emissions than many other sources. The idea that Canadian oil is dirtier compared to imported oil is no longer true. CCUS will take those emissions to zero during the extraction and production process.

As much as the enviro-elitists would like, the oil industry is not going away.

A recent report from Canada’s Energy Regulator (CER) predicts that oil production in Canada will grow from 5 million barrels today (3 million just from the big six oil sands producers) to peak between 5.8 to 6.7 million by 2040 then slowly decline into the 22nd century. Yet the industry plans to achieve net-zero carbon emissions by 2050. It is impossible to imagine this goal being achieved without CCUS. It is frightening to imagine the environmental consequences of failing to meet this goal. The enduring political tension and rhetoric between Eastern and Western Canada could also place a strain on national unity.

Without a CCUS tax credit, incentivizing the industry to carry the cost of sequestering all emissions from oil production will be far more difficult. It would also make Canadian oil products less competitive in a profit-driven US marketplace that already has a CCUS tax credit and sustainable fuel targets in place. CCUS also sets the stage for the next steps — DCCUS and eFuel production.

While 30% of oil sands emissions come from extraction and refining, 70% of emissions are created when the oil is burned to provide transportation, heating and in running industry. Achieving net-zero emission during extraction and refining of oil is only one third of the way towards creating a real net-zero carbon economy. Three times the volume of carbon will need to be captured directly out of the atmosphere compared to what is captured during the creation of fuel from the oil sands. This is an expensive cost that will need to be paid for somehow.

But what if there was a way to turn part of that cost into a profit generator? An added profit for the industry rather than an added cost?

Part 3: Turning Emissions Into Aviation Fuel

While selling carbon credits to consumers and industry can generate revenue, it is still a cost, a tax on consumption that most consumers will dodge if they can. Now, a better answer is emerging from a new international marketplace for net-zero emissions fuel for the aviation industry.

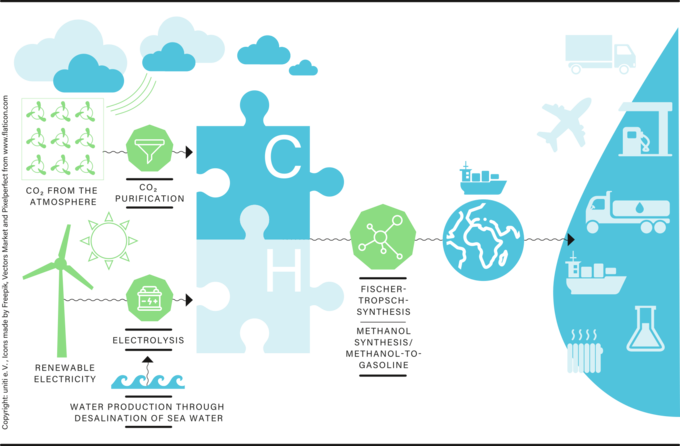

While much attention has been paid to the electrification of cars, trucks and trains with new technology, the aviation industry has focused on SAF (Sustainable Aviation Fuel). While most consumers are already familiar with Biofuel, the most promising of the new fuels is something else completely. It is Sustainable Power to Liquids or Electrofuel (eFuel for short). eFuel is a family of synthetic fuels that can be created utilizing several well-known chemical reactions. Using zero-emissions electricity, eFuel can be produced from industrial emissions or by directly recycling carbon already in the atmosphere.

Due to an international mandate by ICAO (International Civil Aviation Organization) and IATA (International Air Transportation Association), and a lack of supply, the new SAF fuels such as eFuel are expected to be hugely profitable for the private sector firms producing it. A number of Canadian companies are scrambling to get in on what is expected to be the next big opportunity in the oil industry. Canada’s first eFuel plant is currently being built just outside Montreal. The SAF+ Consortium will produce new alternative fuels that will enable net-zero carbon emissions without any changes to engines, equipment or the fuel supply chain. The result is a winning approach to the war on global warming, not just for aviation, but across all forms of transportation and other industries.

In parallel to the reduction of emissions from existing fossil fuel production, the industry can utilize CCUS to ramp up eFuel production. This will prepare the way for DCC (Direct Carbon Capture) to close the loop and enable 100% net zero carbon eFuel production. In time, given the right market demands, eFuel can completely displace fossil fuel for all combustible fuel products.

This does not mean that traditional fossil oil extraction will stop by 2050, but rather that it will shift its products away from combustible fuels. Instead of producing fuel that will release emissions when it is burned, producers could shift with the marketplace producing more valuable products. This could include construction materials such as asphalt, synthetic rubber, lubrication oil and recyclable plastic feed stock. For instance, according to the Rubber Manufacturer’s Association (RMA), it takes about 25 litres of oil to create a standard car tire.

The challenge with large-scale adoption of DCC is that it could be up to six times as expensive than CCUS. The tax credit could reduce the cost to the industry and encourage the large-scale adoption of the technology. Many challenges remain, but the technology is proven and new eFuel plants are already being built in Canada and around the world.

Today, Ontario and Quebec refineries get most of their oil from western Canada through the Line 5 and Line 61 pipelines. This is supplemented with imported foreign oil. Switching completely to a Canadian source of zero-emissions eFuel, produced as close as possible to the point of use, will enable control over our emissions and reduce the need for pipelines and overseas oil tankers. Ontario and Quebec already have one of the lowest-emissions electrical grids in the world. DCC technology and excess zero-emissions electricity can be used to create eFuel that can help these provinces kick their dirty foreign oil habit.

Conclusion: A Net-Zero Carbon Oil Industry Will Create Economic Prosperity

The current Federal government has reiterated its commitment to phasing out federal subsidies for the oil industry (first announced in 2009 by Stephen Harper’s Conservative government). The CCUS tax credit is being misconstrued by some as a new subsidy that could prolong the use of combustible fossil fuel products. The reality is the exact opposite.

The tax credit will kick off a new era of net-zero emission fuel production. Sustainable oil and gas have been called Canada’s secret “Deficit Buster” due to the size of its expected contribution to Canada’s future GDP.

While there is no harm in academics and Green Party politicians encouraging consumers to change their behaviour, shutting down the oil industry or blocking its transformation into a green industry is impractical and counterproductive. The real solution to achieving net- zero emissions by 2050 is a technological one. Incentivizing industry to build CCUS and DCC capacity with a new tax break is the first step towards a real solution. Using that captured carbon to produce zero- emissions products and fuels is the next big leap on the path to net-zero emissions for all Canadians.

The next decade will see more change in the Canadian oil industry than took place in the last half century. As the world moves to net-zero, Canada has an unprecedented economic and technological head start. Smart regulations combined with Canadian ingenuity can build a prosperous stable long-term net-zero economy.

One of our most important tools will be carbon capture infrastructure and a competitive synthetic Oil industry first born in the oil sands of Alberta.

References:

Oil Sands: GHG Emissions – US (nrcan.gc.ca)

Enhancements to the New Section 45Q Tax Credit (natlawreview.com)

Minister of Environment and Climate Change Mandate Letter (pm.gc.ca)

Many Albertans still fine with an oil-and-gas future (irpp.org)

Greenpeace Report: Fossil Fuel Racism – Greenpeace USA

Alberta Mining and Oil and Gas Extraction Industry Profile, 2020

Letter-from-Academics-re-CCUS-tax-investment-credit_January-2022-4.pdf (yorku.ca)

Green’s May: ‘Shut down the oil and gas business’ – The Western Standard (westernstandardonline.com)

Conservatives for Clean Growth

Canada’s Economic Contribution | Canada Natural Resources & GDP (capp.ca)

What Are Greenhouse Gases | GHG Emissions & Canada’s Carbon Footprint (capp.ca)